Q3 Results of 2025

Infortar’s sales volume grew by one-third in the third quarter, reaching 468 million euros, EBITDA amounted to 105 million euros, and net profit to 72 million euros. Over the first nine months, the Group’s revenue increased to 1.4 billion euros, and total investments reached 96 million euros.

A recording of the webinar presenting the second-quarter results is available HERE.

“We delivered a strong quarterly result, with all business segments contributing more significantly than a year ago. The considerable growth in sales volumes has had a positive impact on profitability, higher revenues have translated into increased profit. Tallink has successfully adapted to the regional economic challenges and market environment, increasing passenger numbers. Following a mild winter, Elenger expanded its market share in Finland and the Baltic region to a record 30% over the summer months. In the real estate and construction segment, we continue work on several large infrastructure projects, including the construction of the main line of Rail Baltica,” said Ain Hanschmidt, CEO of Infortar.

“The Group companies Tallink and Elenger have jointly taken a significant step towards sustainability – Tallink’s newest shuttle vessel, MyStar, began using bio-LNG fuel in the third quarter, with the aim of transitioning both MyStar and Megastar fully to bio-LNG. Tallink is setting an example for other operators and helping to reduce the environmental footprint across the Baltic Sea,” Hanschmidt added.

“Major changes are also taking place in onshore gas consumption. In Estonia, the share of locally produced biomethane – derived from cattle manure and biowaste – has already grown to nearly 10% of the country’s total gas consumption, thereby strengthening our overall energy independence. In the transport sector, imported fossil gas has already been replaced by locally produced green gas, transforming what was once a fossil fuel into a renewable and domestic source of energy,” Hanschmidt noted.

The Group’s sales revenue for nine months totalled €1.419 billion, with EBITDA of €190 million and a net profit of €58 million. As of 30 September 2025, the company’s equity stood at €1.2 billion, and total assets at €2.5 billion. In July this year, the company paid out €31 million in dividends.

Q2 Results of 2025

Infortar’s second-quarter sales volumes reached a record-breaking €505 million, exceeding the result of the same period last year by more than 2.5 times.

A recording of the webinar presenting the second-quarter results is available HERE.

"The second quarter was successful in the energy sector – we strengthened our market positions, increased both energy sales volumes and profitability, particularly in the Polish market and in infrastructure," said Ain Hanschmidt. "Maritime transport also showed signs of recovery, reflecting renewed customer confidence and the restoration of travel capabilities. In the real estate and construction segment, we handed over the Pärnu bridge to the client and continue to work on several major infrastructure projects, including the construction of the Rail Baltica main line.

One of the most notable transactions of the half-year also took place in the second quarter – the signing of the agreement to acquire Estonia Farms. For Infortar, this marks a significant expansion into agriculture – Estonia Farms and the Halinga farm acquired last year produce 160 tonnes of milk daily, accounting for 6.5% of Estonia’s total milk output. Integrating milk production with circular economy practices and renewable energy enables us to further expand the bioeconomy sector and produce domestic green gas.

This half-year, we have invested €38 million across various projects, including the construction of one of Estonia’s largest biogas plants in Halinga, a new solar power plant in Olaine Municipality, Latvia, and repair and upgrade works on the cruise ship Baltic Princess. While the energy segment’s profitability has grown and EBITDA has reached €20 million, the maritime transport result was affected by only two idle vessels (compared to four previously) and dividend withholding tax. The construction and real estate segment has remained on a path of stable growth."

Elenger Group increased its second-quarter sales volume by nearly a quarter compared to the same period last year, reaching a total of 4.9 TWh. The company’s gas sales market share in the Finland-Baltic region grew to 28%. Energy sales in Estonia accounted for 10% of the second-quarter total in 2025.

Since 1 August of last year, Infortar has also been consolidating the results of Tallink in its reports. In Q2 2025, AS Tallink Grupp transported a total of 1,488,128 passengers, representing a 2.5% increase compared to the same period last year. While the transport of passenger vehicles grew by 1.4%, reaching 212,782 units, the number of cargo units transported fell by 22.8% to 67,038 units.

Infortar’s second-quarter EBITDA was €57.4 million and pre-tax profit €15.5 million, marking a 50% increase from Q2 2024. However, due to a €17 million income tax charge, the net result for the quarter was a loss of €1.6 million. As of 30 June 2025, total assets amounted to €2.5 billion.

The Group’s sales revenue for the first half of the year totalled €951 million, with a net loss of €14 million.

As of 30 June 2025, the company’s equity stood at €1.174 billion, and total assets at €2.499 billion. In July this year, the company paid out €31 million in dividends.

Cornerstone Laid for Halinga Biomethane Plant

At a ceremony held in Langerma, the cornerstone was laid for one of Estonia’s largest biomethane plants by Minister of Infrastructure Kuldar Leis, Mayor of Põhja-Pärnumaa Municipality Madis Koit, CEO of Infortar Ain Hanschmidt, and Head of Halinga Raul Peetson.

Infortar, together with its partners, has invested nearly €30 million in green gas plants and launched biomethane production in Oisu (Järva County), Ilmatsalu (Tartu County), and Vinni (Lääne-Viru County). The main customers of green gas today are the public transport operators in Tartu, Rakvere, and Pärnu. Green gas is also available as a motor fuel at gas stations across Estonia.

Biomethane is a fully domestic Estonian fuel, produced primarily from manure and waste. The annual manure from one dairy cow can yield 200 kg of green gas — enough to drive 5,000 kilometres.

“This is a unique project for the region – alongside wind and solar farms, Pärnu County will now get its first green gas plant. The idea emerged twenty years ago, and the zoning plan was adopted ten years ago. Now construction has begun, and the plant is set to start operating next spring. In addition to livestock manure, the future plant will be able to process all biodegradable waste, including food waste from Pärnu County,” noted Raul Peetson, Head of Halinga OÜ, one of Estonia’s largest dairy producers and part of the Infortar group.

Watch the video of the event here.

New Pärnu Bridge is Complete

The new Pärnu Bridge, built by INF Infra, has received its usage permit and is ready for the official opening celebrations.

“Everything has gone smoothly and according to plan. The bridge was completed within a short timeframe, without significantly disrupting the daily lives of residents. During the two-year construction period, we made 25 changes in collaboration with the contractor to achieve the highest possible quality, costing nearly €900,000. A dream of thirty years – a new bridge – has finally come true,” said Meelis Kukk, Deputy Mayor of Pärnu and project lead on behalf of the client.

“The Pärnu Bridge is one of the most complex engineering projects in Estonia in recent decades. It showcases innovative construction technology, where the bridge is first built onshore and then installed in its final location. This approach is environmentally friendly and allows the two riverbanks to be connected significantly faster than with traditional construction methods,” explained Robert Sinikas, CEO of INF Infra OÜ, part of the Infortar group.

Construction of the Pärnu Bridge began two years ago in summer. Piling works were completed by autumn of the same year, and construction of the bridge piers took place in the middle of the following year. The new 140-metre-long, nearly 950-tonne steel arch was placed onto river piers in August last year. The arch bridge, assembled on the riverbank, was transported onto the traffic bridge using self-propelled transporters, transferred onto barges, and floated into position over the piers, where it was carefully lowered into its final location with the help of jacks. Moving the tied-arch structure across the Pärnu River took four days, advancing centimetre by centimetre. Over the past year, work has continued on the deck slab, approach roads, and other parts of the project.

In addition to street lighting, the bridge features decorative lighting illuminating its piers, arches, and trusses. The bridge piers are adorned with cheerful animals, birds, and famous Pärnu landmarks, drawn by Nikole Matikainen and her team.

Pärnu’s third bridge now boasts the longest span in Estonia at 140 metres. This allows the navigable section of the river to be used across its full width without obstruction. Previously, the longest bridge spans in Estonia belonged to the Rannu-Jõesuu and Ihaste bridges, each with a maximum span of 90 metres. The Pärnu Bridge exceeds these by one and a half times. It is also the longest tied-arch bridge in the Baltic States and Finland.

The bridge was designed and built by engineering and construction companies INF Infra OÜ and AS EG Ehitus, both part of the investment company Infortar group. The City Government signed a €26.7 million design and construction contract with the companies.

Watch the delightful video of how the builders celebrated the completion of the bridge.

Q1 Results of 2025

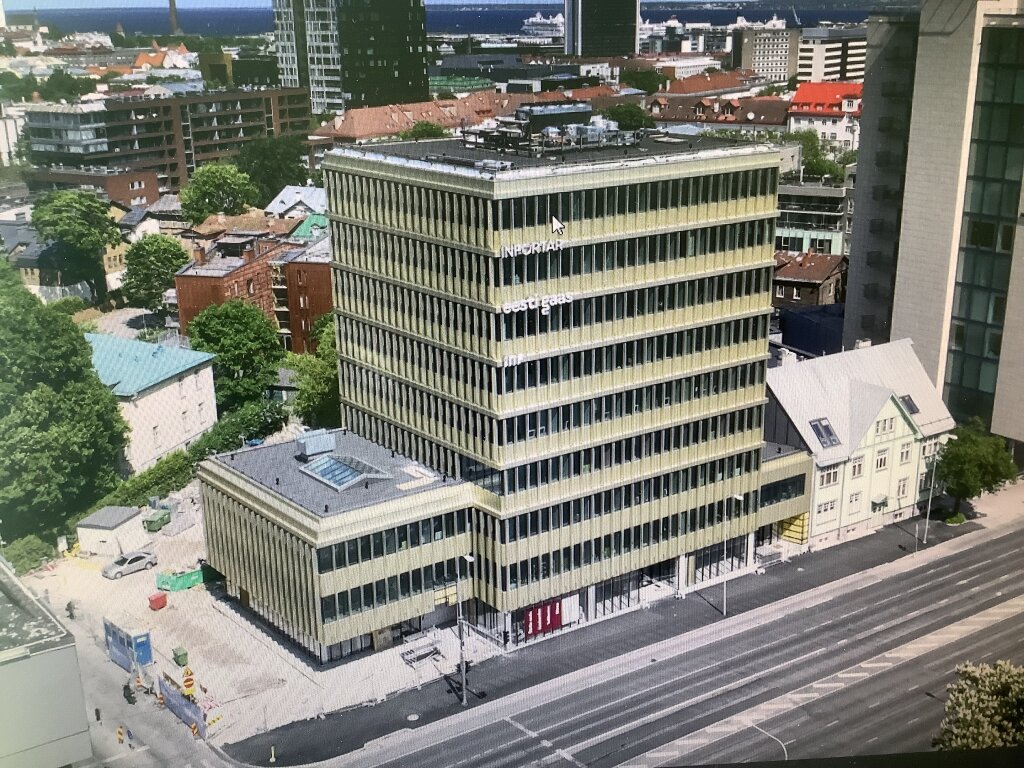

Infortar increased its turnover by 20% in the first quarter of the year compared to the same period last year, reaching €447 million. The group’s total assets nearly doubled to €2.6 billion, while investments tripled to €22 million. In recent years, Infortar has nearly doubled the size of its real estate portfolio and is actively expanding across multiple sectors.

The recording of the webinar presenting the results of the first quarter of 2025 can be viewed here.

Since August 1st of last year, the results of Tallink, a group company, have been consolidated into Infortar’s financial statements. Due to the highly seasonal nature of the maritime transport business, Tallink’s first-quarter loss of €33 million was reflected in Infortar’s own results. An additional impact came from a €1.7 million income tax expense, resulting in a total net loss of €14.6 million for Infortar in the first quarter, of which €4.5 million was attributable to Infortar’s shareholders. The energy business was affected by an exceptionally warm winter and lower consumption, but remained profitable overall. The real estate segment, meanwhile, showed significant year-on-year growth in volumes.

“The economy stands on three pillars – agriculture, industry, and services. In recent years, Infortar has expanded its presence across all three to achieve its goals and diversify risk. Moreover, we have grown into a market leader in each,” said Ain Hanschmidt, CEO Infortar.

“The performance of Tallink had the biggest impact on Infortar’s first-quarter profitability. In addition to typical seasonality, passenger numbers in the first quarter reflected the state of the core markets' economies and low consumer confidence. Still, it is important to note that the most challenging period of the year is now behind Tallink, and the outlook is more optimistic. The energy business was affected by an exceptionally mild winter, lower consumption, and a gas surplus. Nevertheless, the segment remained profitable, primarily due to well-placed investments in gas distribution networks in Latvia and Poland. In real estate, we continued rapid growth – over the past year, we have expanded our portfolio by nearly 50%, becoming one of the largest property owners in the Baltics. Despite a turbulent environment, Infortar continues to grow as one of the largest investment companies on the eastern coast of the Baltic Sea, actively seeking new investment opportunities. Our balance sheet strength is the key indicator of resilience – Infortar's financial position and liquidity remain solid, free liquidity is €153 million enabling us to generate cash and invest. We can also confirm our continued commitment to the stated dividend policy. Diversification across sectors and countries has created a strong platform that provides confidence even in volatile times,” Hanschmidt concluded.

Infortar’s Assets Doubled

Infortar has published its consolidated financial results for 2024, which can be viewed here. A webinar covering the results is available for replay.

Following the acquisition of a majority stake in Tallink and the purchase of a gas company in Poland, Infortar’s asset volume grew from €1.4 billion to €2.7 billion. Infortar’s share price rose by 70% during its first year on the stock exchange, and the company’s total value increased from €548 million to €916 million. The group’s revenue grew by a quarter last year, reaching €1.37 billion, with profits amounting to €174 million. The company’s management board has proposed, as it did last year, to distribute dividends of €3 per share to its more than 6,000 shareholders, totalling €61.33 million — reportedly the largest dividend payout in the history of companies listed on the Tallinn Stock Exchange.

"Our investments over the past few years have totalled nearly half a billion euros. Thanks to the right investment decisions, we have grown into one of Estonia’s largest companies by asset volume within a year. We will continue to seek growth across the region," said Ain Hanschmidt, Chairman of Infortar’s Management Board. "Changes are currently taking place to improve corporate competitiveness and energy policies in Estonia, Europe, and the United States. Natural gas is expected to play a bigger role in supporting renewable energy and ensuring controllable capacities. Additionally, the situation in the maritime transport sector can only improve," Hanschmidt added.

Last year, Infortar made three major investments. In spring, the company entered the agriculture sector by acquiring one of Estonia’s largest dairy farms in Halinga and began constructing a biogas plant next to the farm for local gas production. During spring and summer, the group invested €110 million in acquiring Tallink shares, increasing its stake to 68.5%. In autumn, its subsidiary Elenger signed a €120 million deal with the German energy giant EWE AG to acquire all of EWE Group’s business operations in Poland. The deal includes a natural gas distribution network in Western Poland and all business areas of energy sales. Infortar’s real estate portfolio grew from 100,000 to 141,000 square metres over the year. At the end of last year, a Rimi logistics centre in Saue Parish was granted its usage permit, while this summer will see the completion of the new Pärnu bridge. Next year, a second DEPO store in Lasnamäe will open, and by early 2028, the Kangru-Saku section of the Rail Baltica mainline will be completed.

To strengthen its market position domestically and abroad, Infortar added the long-established Tallinn Book Printers to its group of companies. In 2024, the group exited several smaller, unprofitable sectors, such as taxi services and pharmaceutical sales.

The proposed dividend of €3 per share consists of three parts: the minimum €1 per share promised during the IPO, a €1.5 share from Tallink’s retained earnings, and an additional €0.5 as an extra dividend. Dividend payments will be made in two equal instalments in July and December of this year, following the company’s dividend policy.

Infortar operates in seven countries, with its core business areas being maritime transport, energy, and real estate. Infortar holds a 68.5% stake in AS Tallink Grupp, 100% ownership of AS Elenger Grupp, and a diverse and modern real estate portfolio totalling around 141,000 m². In addition to its core sectors, Infortar is active in construction and mining, agriculture, printing, and other industries. The Infortar group consists of 110 companies: 101 group companies, 4 associates, and 5 subsidiaries of associated companies. Excluding associates, Infortar employs 6,228 people.

Q4 Results of 2024

Infortar will organize a webinar for investors on 25 February 2025 at 12:00 (EET) in Estonian and at 14:00 (EET) in English to introduce the fourth quarter 2024 results. The webinar will be attended by the Chairman of the Board of Infortar Ain Hanschmidt, the Managing Director of Infortar Martti Talgre and Investor Relations Manager Kadri Laanvee.

The webinar will be hosted on the Microsoft Teams platform. Please note that to participate, no prior registration is required, and no reminder of the webinar will be sent. You can either participate by joining from your web browser or via Microsoft Teams application. When using a smart device to join the webinar, you first need to download the Microsoft Teams application from either Play Store or App Store.

Please join the webinar via the following links:

25 February 2025 at 12:00 (EET) Estonian webinar

25 February 2025 at 14:00 (EET) English webinar

Questions can be sent to investor@infortar.ee before the webinar and via Teams Q/A during the event. The webinar will be recorded and will be available online for everyone on the company’s website at https://infortar.ee/en/reports.

Infortar to Build Green Gas Plant in Pärnu

One of Estonia's largest dairy companies, Halinga OÜ, is beginning construction on a €13.3 million biomethane plant. The plant, which will produce domestic gas from livestock manure and biowaste, will be designed and built by Germany's largest green gas producer.

"Modern agriculture operates in conjunction with circular economy and renewable energy projects. Infortar has extensive experience in these fields and continues to invest in domestic green gas," noted Ain Hanschmidt, CEO at Infortar.

"The biomethane plant will help Halinga achieve its environmental goals by significantly reducing the ecological footprint of our dairy production. Additionally, the plant will create new jobs requiring specialized knowledge in a sector where such demand has not previously existed," said Raul Peetson, Halinga's Managing Director.

The biogas plant, located in Langerma village, Pärnu County, will feature four fermenters and is being designed and constructed by Germany's largest biomethane producer, EnviTec Biogas AG through its subsidiary EnviTec Anlagenbau GmbH & Co KG. The project is funded by the European Union's NextGenerationEU recovery fund, with construction expected to be completed by the spring of 2026. The total project cost is €13.3 million, of which €5 million is supported by KIK (the Environmental Investment Centre).

Together with its partners, Infortar has invested nearly €30 million in biomethane plants, launching green gas production facilities in Oisu (Järva County), Ilmatsalu (Tartu County), and Vinni (Lääne-Viru County). Major green gas clients include public transport companies in Tartu, Rakvere, and Pärnu, and biomethane is available as motor fuel at gas stations across Estonia. For more information about green gas production, visit www.rohegaasijaam.ee.

This spring, Infortar acquired a 51% stake in Halinga, one of the largest dairy companies in Estonia, located in Pärnu County.

EnviTec Biogas AG has already supplied three purification systems to Estonia, located at the Oisu, Vinni, and Tartu biomethane plants. Thanks to the collaboration between Eesti Biogaas OÜ and EnviTec, 430 GWh of domestic green gas has been delivered to Estonia’s transport sector to date.

Webinar on Q3 Results

Infortar is organising a webinar on November 4 at 2:00 PM to present this year’s Q3 results. The webinar will feature CEO Ain Hanschmidt, Managing Director Martti Talgre, and Head of Investor Relations Kadri Laanvee. The event will take place on Microsoft Teams. You can join the webinar either via a web browser or the Microsoft Teams app. If using a mobile device, please download the Microsoft Teams app in advance from Google Play or the App Store.

To join the webinar, please use the following link: English webinar link

Questions can be sent to Kadri Laanvee at kadri.laanvee@infortar.ee before the webinar or through the Teams Q&A feature during the event. The webinar will be recorded and made available on the website: https://infortar.ee/en/reports.

Results of the Q2 2024

Infortar's sales volumes increased by 40 percent in the first half of the year, with revenue reaching 576 million euros and net profit totaling 73 million euros. The value of Infortar's assets reached 1.5 billion euros, and investments amounted to 41 million euros.

"We have strengthened our positions in the Finnish and Baltic energy markets, gained market share, increased sales, and filled our storage for the next season in the first half of the year – our fundamentals are strong and liquidity position solid, providing us a robust platform to continue our investments," said Ain Hanschmidt, Chairman of the Management Board of Infortar.

"The results of Infortar's main investments are strongly seasonal – energy shows high figures during the cold period, while the number of ferry passengers peaks in the summer," Hanschmidt stated.

In the first half of this year, Infortar invested 41.3 million euros. The company increased its stake in Tallink to 46.8 percent, acquired a majority stake in Halinga dairy farm in Pärnumaa, and opened a solar park in Nica, Latvia. The focus was to expand operations in Poland and Germany and establish access to the wholesale gas market in the Netherlands and Belgium. The construction of the RIMI logistics center and the new bridge in Pärnu have progressed according to schedule.

Eesti Gaas, the largest privately-owned energy company in the Finnish and Baltic regions, owned by Infortar (operating under the name Elenger in foreign markets), increased its sales volume by 40 percent compared to the previous half-year, totaling 10 TWh. The company's market share in the Finnish-Baltic gas market is 25.4 percent.

The number of Tallink passengers on the Helsinki route has increased compared to last year, while the movement of people between Finland and Sweden slightly decreased compared to the same period last year. In June, Infortar announced a voluntary takeover offer to Tallink shareholders. The offer is directed at all investors and will bring additional liquidity to the market, providing an exit opportunity for those who might find it challenging to realize their shares on the stock exchange under normal circumstances.

As of June 30 of this year, Infortar's equity amounted to 840 million euros, and the volume of assets was 1.5 billion euros. Compared to the results of the first six months of last year, Infortar's EBITDA and net profit decreased by 11 million euros. The EBITDA for the first six months of 2024 was 76 million euros, and the net profit was 73 million euros.

The English-speaking webinar presenting the six-month financial results can be viewed HERE.

Record-breaking first quarter

On the 6th of May, a webinar took place where Martti Talgre, and Kadri Laanvee discussed the record-breaking results of Infortar for the first quarter of 2024 – revenue increased to 373 million euros and net profit to 62 million euros. The webinar can be viewed here.

"Infortar successfully managed to increase its sales volumes amidst stabilized energy prices and continue its expansion into new markets and sectors. Today, over 80 percent of our revenue comes from foreign markets, our investments have been profitable, and as one of the region's largest investment companies, we are constantly seeking growth opportunities," noted Ain Hanschmidt, CEO of Infortar.

Infortar's largest private equity energy company in the Finnish and Baltic region, Eesti Gaas (known as Elenger in foreign markets), increased its sales volume by 74 percent compared to the same period last year, reaching a total of 6.1 TWh. The company's market share in gas sales in the Finland-Baltic market increased to 26.4 percent, and Eesti Gaas/Elenger imports about a third of the gas arriving in the region.

In addition to energy, shipping, and real estate, Infortar entered the agricultural sector by acquiring a majority stake in one of Estonia's largest dairy farms in Halinga, Pärnumaa. Tallink, in the maritime transport sector, posted a profit in the first quarter. In the real estate sector, the expansion of Tallink's logistics center in Maardu was completed at the beginning of the year, construction continues on the 25,000 m2 RIMI logistics center in Saue municipality, and work on a new bridge in Pärnu is underway.

Compared to the first quarter of last year, Infortar's EBITDA grew by 40 percent and profit by 32 percent. Infortar's equity amounted to 853 million euros as of March 31st this year, with assets totaling 1.4 billion euros. The company made investments totaling 7 million euros in the first quarter.

Consolidated Annual Report 2023

Infortar's 2023 annual report, as of April 24th, has been audited and approved by the Supervisory Board, and is now awaiting confirmation from the shareholders at the general meeting scheduled for May 20th. At the meeting, the group's Supervisory and Management Board will propose a dividend payment of 3 euros per share based on the financial results of 2023. The report highlights significant events such as the doubling of electricity and gas sales volumes, the acquisition of the Latvian gas network Gaso, and increased stake in Tallink Group, as well as the construction of the RIMI logistics center and the new bridge in Pärnu. For the first time, the company’s sustainability report has been published, prepared in collaboration with specialists from PricewaterhouseCoopers. The text of the financial report, along with all the figures, can be seen in its entirety HERE.

The Annual General Meeting is held on May 20

On April 24, Infortar's Supervisory Board approved the annual report prepared by the Management Board and the agenda for the Annual General Meeting of Shareholders. The meeting will be held on Monday, May 20, at 11 AM at the Tallink SPA and Conference Hotel conference center, Sadama 11a. Shareholder registration starts at 10 AM, and shareholders can vote by email before the general meeting. We look forward to your active participation! The full text of the notice can be found HERE.

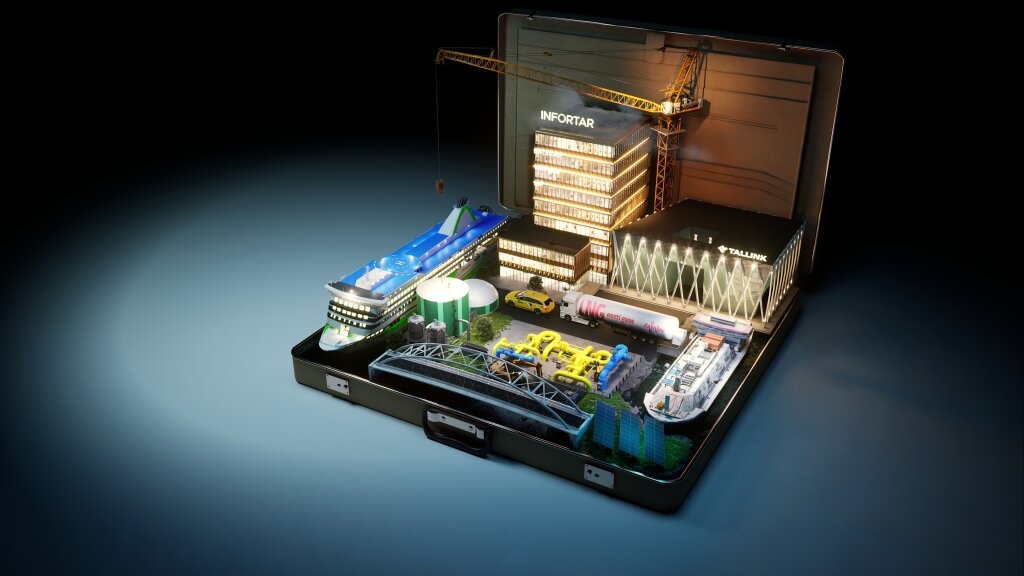

Infortar's IPO campaign won an award

Infortar's IPO received another high accolade and award - the Golden Egg in the corporate PR category from the Estonian Marketers' Association. The campaign was carried out by Hamburg and Partners who also won the PR communication agency of the year in 2023 & 2024.

Thanks for the great collaboration: LHV, Swedbank, Ellex Raidla Law Firm, COBALT Law Firm, KPMG, Newton Marketing, 3D designer Sander Tuvikene, and MediaBroker.

Infortar 2023 unaudited financial results

On February 26, the management of AS Infortar announced the financial results for the fourth quarter of 2023 and commented on both the results and the principles of dividends to be paid at a webinar. The webinar can be watched here.

"The financial results of the group for the past year are adorned with the largest profit of all time - in the results of the first 9 months, we announced that the volume of our assets approached 1.5 billion. We were able to adapt quickly and flexibly during difficult times, turn the demanding challenges arising from market changes into success, and ultimately achieve a strong result," said Ain Hanschmidt, Chairman of the Board of Infortar.

The brightest events in the company's activities over the last twelve months were undoubtedly related to energy, and the number of passengers on the Baltic Sea also recovered to the pre-pandemic level.

"Despite the extraordinary year, these were not one-off results - Infortar's shares with the trading symbol INF1T are listed on the Tallinn Stock Exchange, our investment portfolio is diverse and cross-border, proven in crises and has great growth potential. As long-term experienced investors ourselves, we want to offer our investors dividend security," added Hanschmidt.

Infortar's IPO was a success

In the initial public offering (IPO) of AS Infortar, a total of 5,517 retail investors from Estonia and professional investors from Europe participated. The total volume of subscriptions submitted by investors reached 41.4 million euros, which is 1.3 times more than the base offer size of 31.2 million euros.

The final price for AS Infortar shares was confirmed at 26 euros. The company decided to allocate a total of 1,360,000 offered shares to investors, with 160,000 shares to be distributed through the overallotment option. The total offering size, based on the final price, amounted to 35.4 million euros. The expected first trading day for Infortar shares is December 14.

"When the economy declines, Infortar grows, raises funds, and goes public. Conducting the IPO in our characteristic contrarian manner, we managed to achieve a strong result in a challenging environment. Going public and raising capital gives us an extra boost for international expansion. We appreciate those who trusted us and our portfolio – all retail investors who subscribed to Infortar will receive shares in the desired quantity and at the lower end of the price range," said CEO Ain Hanschmidt.

"Infortar's IPO is the largest in the Baltic region in the last two years, and based on market capitalization, it is the third-largest company on the Nasdaq Tallinn Stock Exchange. Despite a challenging environment, the transaction proved successful and provides Infortar with the opportunity to realize its development plans as a public company with a broad shareholder base. The active participation of retail investors, which was also a significant focus for the company, is pleasing," said Mihkel Torim, Head of Investment Banking at LHV.

According to the prospectus for Infortar's initial public offering, individuals and entities in Estonia, as well as professional investors in European Economic Area member states and the United Kingdom, could subscribe to shares from November 28 to December 7. Trading of Infortar shares on the Nasdaq Tallinn Stock Exchange's Baltic Main List begins on December 14 or a nearby date.

Existing shareholders of Infortar have entered into a lock-up agreement, stipulating that major shareholders are not allowed to sell their Infortar shares without the consent of the organizers for 12 months, and minor shareholders for 6 months from the listing of the shares.

LHV and Swedbank organized the initial public offering of AS Infortar, Ellex Raidla served as Infortar's legal advisor, Cobalt as the legal advisor for the banks, and Hamburg ja Partnerid as the communication advisor. Details of the offering are provided in the prospectus, available electronically on Infortar's website (https://infortar.ee/et/ipo) and the Financial Inspectorate (FI) website www.fi.ee.

For more information:

Kadri Laanvee

Head of Investor Relations, AS Infortar

----IMPORTANT----

Not for distribution in the United States of America or in any other jurisdiction where such distribution would be illegal. This is an advertisement. Before making an investment decision, please read the prospectus at www.infortar.ee/et/ipo to fully understand all associated potential risks and rewards. The approval of the prospectus by the Estonian Financial Supervision and Resolution Authority should not be understood as an endorsement of the securities offered by the issuer.

Infortar's ITF

AKTSIASELTS INFORTAR (“Infortar”) announced on 20 November 2023 its intention to commence with the process of organising an initial public offering (the “Offering”) and listing of its ordinary shares (the “Shares”) on the Baltic Main List of the Nasdaq Tallinn Stock Exchange (the “Tallinn Stock Exchange”).

With the Offering, Infortar aims to provide investors an opportunity to invest in one of the biggest investment holding companies in the Baltics[1] whose portfolio is comprised of companies active in energy, shipping, real estate, and other fields.

Under the Offering, Infortar intends to offer newly issued Shares.

As a result of the Offering Infortar aims to widen its investor base and by listing create liquidity for the Shares. Infortar hopes that the Offering increases the reputation of Inforar and its subsidiaries (“Group”) amongst existing and potential clients and cooperation partners and creates additional funding opportunities, thus supporting the fulfilment of Group’s long-term strategy.

This announcement is an advertisement and is not a prospectus for the purposes of Regulation (EU) 2017/1129, as amended (the “Prospectus Regulation”) and is not an announcement of a public offer of securities or a call to subscribe for the shares of Aktsiaselts Infortar (“Infortar”). Before making an investment decision all potential investors should read Infortar’s prospectus and if necessary, consult an expert. Investors should make an investment decision with respect to securities referred to in this announcement solely based on the information contained in the prospectus of Infortar, that is approved by the Estonian Financial Supervision Authority (the “EFSA”), in order to fully understand the potential risks and rewards associated. Infortar will release further information regarding the approval of the prospectus in accordance with the Prospectus Regulation and will make such information available on the website of the EFSA (at www.fi.ee) and of Infortar (at https://infortar.ee/et/ipo). The approval of the prospectus by the EFSA should not be understood as an endorsement of the securities.

Details of the Offering

The Offering will consist of (i) an offering to retail investors in Estonia (the “Retail Offering”) and (ii) an offering to qualified investors, within the meaning of Prospectus Regulation, in Estonia and certain member states of the European Economic Area (“Institutional Offering”). In addition, Infortar may, within the limits of the Offering decide to offer Shares non-publicly to investors in the member states of the European Economic Area based on other exemptions in the Prospectus Regulation. Public offering shall take place only in Estonia and Shares are not publicly offered in any other jurisdiction.

The exact structure and timing of the Offering is subject to, among other things, prevailing market conditions and the timing of receiving necessary approvals from the EFSA, as well as obtaining relevant corporate approvals and concluding necessary agreements.

Arrangers of the Offering are AS LHV Pank and Swedbank AS (“Arrangers”). Settlement agent of the Offering is AS LHV Pank.

Infortar - management board member Ain Hanschmidt:

“Infortar has become one of the biggest companies in Estonia with a revenue of billion euros, the next logical step is to be listed and public. Expanding the investor base and joining the stock exchange gives us an opportunity to grow even faster internationally, increase our asset value and find additional financing opportunities. For investors this means having access to a diverse and international, inflation and crises tested portfolio offering both real assets and growth potential.”

Infortar - managing director Martti Talgre:

“Infortar’s operating areas – energy, shipping and real estate are capital heavy, stable, with strong cash flow and high entry barriers. Investments to three different areas provide sufficient diversification whilst enabling to stay focused. A strong and diverse portfolio has given us the basis for continuing our growth. We have proven that we can make quick decisions and take advantage of new opportunities growing faster than the Estonian economy in general.”

Eesti Gaas - chairman of the management board Margus Kaasik:

„For a long time now, Infortar’s subsidiary Eesti Gaas, is no longer just “Estonian” and just “gas”. We have grown to become the biggest privately owned energy company in Finland and Baltic region, we are active in international energy trade and develop our renewable energy portfolio by production and sales of solar energy and biogas. Since being acquired by Infortar, Eesti Gaas has doubled its gas sale volumes, initiated the development of renewable energies and grown to become an international corporation.”

Infortar in brief:

Based on asset volume, Infortar is one of the biggest investment holding companies in the Baltics.[2] During over 25 year of active business, Infortar has gradually increased its investment portfolio and as of the date of this announcement the Group consists of 48 subsidiaries, additionally, the Group has made investments in 5 affiliate and joint-venture companies. The Group is focused on three main fields – energy, maritime transport and real estate, in addition, the Group has investments in fields supporting its main operations. Infortar tries to find synergies in its investments and focuses on creating well-functioning companies that have a prominent position on the market.

The management board of Infortar is highly experienced and its members are Ain Hanschmidt and Eve Pant. The managing director of Infortar is Martti Talgre.

Infortar makes its investments based on long-term social and economic trends whilst creating synergies amongst Group companies. Group’s investment action plan for the coming years includes projects with total volume of EUR 110 million, most important of which are Rimi office and warehouse building, expansion of Tallink Duty Free logistics centre, DIY store at Tallink tennis centre premises, Hiiu health centre and over 40 MW panel capacity solar parks in Estonia and Latvia.

In 2022 the Group’s consolidated revenue was EUR 1 054 million, EBITDA was EUR 120 million and net profit was EUR 96 million. In 2023 total dividend payments amounted to approximately EUR 16 million. Currently Infortar has issued 19,845,000 Shares.

Key strengths of Infortar

Infortar considers its main competitive advantages and strengths and strategies supporting its activities to be:

· Carefully designed investment portfolio and policies focusing on synergies;

· Capability and knowledge to be an active investor participating in decision making and taking responsibility;

· Unique know-how in managing large investments;

· Well diversified investment portfolio both geographically and by business segments.

Infortar strategy

Infortar’s strategy is to find synergies in its investments and create well-functioning companies that have a prominent position on the market with an aim to achieve stable and higher than average growth in investment value and a diverse portfolio with strong asset base and cash flow.

Group’s activities are focused on three primary business segments – energy, shipping and real estate.

Group’s strategy in energy segment is to expand existing and operational business models to new geographic markets, make balanced investments to transitional and renewable energy sources and create synergies between existing and new business lines.

Group’s strategy in real estate segment is to increase its real estate portfolio by purchasing and developing assets in Tallinn and its surroundings. Group invests in assets that match the object-specific criteria of quality, location, and yield.

Dividend policy

Infortar has established a dividend policy according to which Infortar aims to pay out as dividends at least 1 euro per Share per economic year. Dividend payments are executed twice a year.

Wide business profile of the Group is a good precondition for creating a stable cash flow. On the other hand, Group’s strategy requires significant investments and financial leverage. Thus, any future dividend payments and their sum depend on the future financial position of Infortar, results, capital requirements, Group’s liquidity needs, and other circumstances that Infortar may deem relevant from time to time. Proceeding from the foregoing and as according to Estonian laws, the decision to pay dividends is made by the general meeting of the shareholders, Infortar cannot guarantee that dividends will be paid in future or if they are paid, their sum. This section includes forward-looking statements which involve risks and uncertainties, relating to events and depending on circumstances that may or may not occur in the future (for further information, see “Important Notice - Forward-looking statements” below).

Infortar’s financial performance and key consolidated figures

| 9m 2023 | 9m 2022 | 31.12.2022 | 31.12.2021 |

| EUR’000 | |||

Revenue.............................................. | 746,892 | 611,116 | 1,053,712 | 412,565 |

EBITDA............................................... | 105,865 | 110,046 | 120,046 | 46,444 |

Net profit............................................. | 269,624 | 97,798 | 96,124 | 18,868 |

Assets................................................. | 1,431,322 | 1,113,631 | 1,107,412 | 882,517 |

Equity.................................................. | 771,700 | 643,634 | 568,677 | 392,655 |

Net debt.............................................. | 390,360 | 216,147 | 367,203 | 297,183 |

Net debt/EBITDA................................. | 3.4x | 1.7x | 3.1x | 6,4x |

Equity ratio (%) ................................... | 53.9% | 57.8% | 51.4% | 44,5% |

Debt/Equity (%).................................... | 62.3% | 54.9% | 75.1% | 87,2% |

ROA (%).............................................. | 18.8% | 8.8% | 9.7% | 2,4% |

ROE (%).............................................. | 34.9% | 15.2% | 20.0% | 4,9% |

Current ratio ....................................... | 1.4x | 1.9x | 1.4x | 0,9x |

Further enquiries:

Kadri Laanvee

AS Infortar head of investor relations

**** IMPORTANT NOTICE ****

The information contained in this announcement is for background purposes only and does not purport to be full or complete. No reliance may or should be placed by any person for any purposes whatsoever on the information contained in this announcement or on its completeness, accuracy or fairness.

This announcement is an advertisement and is not a prospectus for the purposes of the Prospectus Regulation and is not an announcement of a public offer of securities. Investors should not make an investment decision with respect to securities referred to in this announcement except on the basis of information contained in the prospectus that is approved by EFSA in order to fully understand the potential risks and rewards associated. Infortar will release further information regarding the approval of the prospectus in accordance with the Prospectus Regulation and will make such information available on the website of the EFSA (at www.fi.ee) and of Infortar (at https://infortar.ee/et/ipo). The approval of the prospectus by the EFSA should not be understood as an endorsement of the securities.

This announcement shall not constitute or form part of any offer to sell or the solicitation of an offer to buy, nor shall there be, any Shares in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration, exemption from registration or qualification under the securities laws of any such jurisdiction. Any offer to acquire the Shares will be made, and any investor should make his investment, solely on the basis of information that will be contained in the prospectus and its supplements to be published in connection with such offering. If you do not understand the contents of this announcement you should consult an authorised financial adviser.

This announcement does not constitute a recommendation concerning the Offering. The price and value of securities and any income from them can go down as well as up. Past performance is not a guide to future performance. Information in this announcement or any of the documents relating to the Offering cannot be relied upon as a guide to future performance. Before purchasing any Shares, persons viewing this announcement should ensure that they fully understand and accept the risks which will be set out in the prospectus, when published.

In the European Economic Area, with respect to any Member State, other than Estonia, this communication is only addressed to and is only directed at “qualified investors” in that Member State within the meaning of Article 2(e) of the Prospectus Regulation.

This announcement does not constitute or form a part of any offer or solicitation to purchase or subscribe for the Shares in the United States. The Shares have not been and will not be registered under the US Securities Act of 1933, as amended (the “Securities Act”), and may not be offered or sold in the United States unless the securities are registered under the Securities Act, or an exemption from the registration requirements of the Securities Act is available. Infortar has not registered, and does not intend to register, any portion of the offering in the United States, and does not intend to conduct a public offering of securities in the United States. Any Shares sold in the United States will be sold only to qualified institutional buyers (as defined in Rule 144A under the Securities Act) in reliance on Rule 144A, or another available exemption from the registration requirements of the Securities Act..

The Arrangers are acting exclusively for Infortar and no one else in connection with the Offering. None of the Arrangers will regard any other person (whether or not a recipient of this announcement) as a client in relation to the Offering and will not be responsible to anyone other than Infortar for providing the protections afforded to their respective clients nor for the giving of advice in relation to the Offering or any transaction, matter, or arrangement referred to in this announcement.

In connection with the Offering, the Arrangers and any of their respective affiliates, acting as investors for their own accounts, may subscribe for and/or acquire Shares and in that capacity may retain, purchase, sell, offer to sell or otherwise deal for their own accounts in such Shares and other securities of Infortar or related investments in connection with the Offering or otherwise. Accordingly, references in this announcement to the Shares being issued, offered, subscribed, acquired, placed or otherwise dealt in should be read as including any issue, offer, subscription, acquisition, dealing or placing by, the Arrangers and any of their affiliates acting as investors for their own accounts. In addition, the Arrangers (or any of their respective affiliates) may enter into financing arrangements (including swaps) with investors in connection with which such Arrangers (or any of their respective affiliates) may from time to time acquire, hold or dispose of Shares. None of the Arrangers intends to disclose the extent of any such investment or transactions otherwise than in accordance with any legal or regulatory obligations to do so.

The Arrangers and their respective affiliates may have engaged in transactions with, and provided various investment banking, financial advisory and other services to, Infortar and its shareholder(s), for which they would have received customary fees. The Arrangers and any of their respective affiliates may provide such services to Infortar and its shareholder(s) and any of their respective affiliates in the future.

None of the Arrangers or any of their respective subsidiary undertakings, affiliates or any of their respective directors, officers, employees, advisers, agents or any other person accepts any responsibility or liability whatsoever, or makes any representation or warranty, express or implied, for the contents of this announcement, including its truth, accuracy, completeness, verification or fairness of the information or opinions in this announcement (or whether any information has been omitted from the announcement) or any other information relating to Infortar, the Group and their affiliates, whether written, oral or in a visual or electronic form, and howsoever transmitted or made available or for any loss howsoever arising from any use of this announcement or its contents or otherwise arising in connection therewith.

The information contained in this announcement is for background purposes only and does not purport to be full or complete. No reliance may be placed for any purpose on the information contained in this announcement or its accuracy or completeness. All information presented or contained in this announcement is subject to verification, correction, completion and change without notice. However, Infortar does not undertake to provide the recipient of this announcement with any additional information, or to update this announcement or to correct any inaccuracies.

Forward-looking statements

Certain statements contained in this announcement, including any information as to the Infortar’s strategy, plans or future financial or operating performance constitute “forward-looking statements”. This information is presented based on the prognosis made at the time that in turn are based on the best assessment of Infortar’s management. Certain information is based on Infortar’s management opinions and presumptions and information available at the time. Any forward-looing information includes risks, uncertainties and expectations as to Group’s future activities, macro-economic situation and other similar factors. These forward-looking statements can be identified by the use of forward-looking terminology, including the terms “believes”, “estimates”, “anticipates”, “projects”, “expects”, “intends”, “aims”, “plans”, “predicts”, “may”, “will”, “seeks” or “should” or, in each case, their negative or other variations or comparable terminology, or by discussions of strategy, plans, objectives, goals, future events or intentions. These forward-looking statements include all matters that are not historical facts. They appear in a number of places throughout this announcement and include statements regarding the intentions, beliefs or current expectations of the directors of Infortar concerning, amongst other things, Infortar’s results of operations, financial condition and performance, prospects, growth and strategies and the industry in which Infortar operates. By their nature, forward looking statements address matters that involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. Infortar has no and expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any forward- looking statements contained in this announcement to reflect any change in its expectations or any change in events, conditions or circumstances on which such statements are based.

The validity and accuracy of all forward-looking statements are further affected by the fact the Group operates in the field of strong competition. This field is affected by changes in regulations (including EU), developments in taxation, competition, economic, strategic, political and social conditions, clients’ reactions to new and existing products and technological developments as well as other factors. Group’s actual results may differ from Infortar management’s expectations due changes in these factors. Other factors and risks may have a negative impact on Group’s activities, business of financial results.

[1] As per management assessment.

[2] As per management assessment.

Infortar’s IPO

Today marks the start of the IPO of AS Infortar shares. Physical and legal persons in Estonia can subscribe for shares until next Thursday, December 7, within the price range of 26 to 32 euros per share.

The Estonian Financial Supervisory Authority (Finantsinspektsioon) has approved the prospectus for the initial public offering of Infortar shares. The company has also applied to Nasdaq Tallinn AS for the listing and admission of its shares for trading on the main list of the Nasdaq Tallinn Stock Exchange. The anticipated first trading day for Infortar shares is 14th of December.

Chairman of the Management Board of Infortar Ain Hanschmidt:

“We are opening our portfolio and wish to grow our success with new investors. Our portfolio that is focused on energy, maritime transport and real estate is diverse and international, proven in crises and has a big growth potential. According to our vision, Infortar is dedicated to developing the productivity of its companies – Eesti Gaas has become the biggest private capital energy company in the Finnish and Baltic region, Tallink has become the biggest maritime transport company on the Baltic Sea and for real estate we are one of the biggest asset owners in the region. We are long-term experienced investors and wish to provide dividend security to new investors.”

Managing Director of Infortar Martti Talgre:

“Infortar has a diverse portfolio, strong balance sheet and modest loan burden – our cash flow is secure and enables us to pay dividends. We determined the Offering amount based on the needs of the Company and the price range based on its appeal to the investors. Searching for and utilising of growth opportunities is in the DNA of Infortar. Growth has originated from international expansion and investments that amount to a quarter billion euros in the past years.”

Chairman of the Management Board of Eesti Gaas Margus Kaasik:

“Infortar owner Eesti Gaas earns most of its revenue from foreign markets. We have led the transition to western LNG in the area and thus won new clients and market share. Besides sales we have significantly increased our energy infrastructure sector by acquiring the biggest Latvian gas distribution network and built a bunkering ship. We are also actively involved in renewable energies by producing and selling local biogas and solar energy. In the long run we see natural gas as the main supporting energy type for renewable energy sources.”

According to the prospectus approved by the Estonian Financial Supervisory Authority, physical and legal persons in Estonia, as well as professional investors in European Economic Area member states and the United Kingdom, can subscribe for Infortar shares from 28 November at 10:00 AM until 7 December at 4:00 PM. The number of shares issued during the offering ranges from 1,200,000 to 1,980,000 shares. The price range for the offering is 26 to 32 euros per share, making the financial volume of the offering between 31.2 and 63.4 million euros. Subscription applications in the retail offering will be submitted at the highest level of the price range, which is 32 euros per share.

An investor wishing to subscribe for Infortar shares in the retail offering must contact their account operator, managing the investor's securities account at Nasdaq CSD SE Estonian branch (Nasdaq CSD), and submit a subscription order during the offering period according to the offering conditions. For institutional offering subscription, investors should contact the organizers of the offering.

Existing shareholders of Infortar have entered into a lock-up agreement, which restricts major shareholders from selling their Infortar shares without the consent of the offering organizers for 12 months, and minor shareholders for 6 months following the listing.

The disclosure of AS Infortar's initial public offering price, results, and allocation will take place on December 11th or a date close to it. Trading of Infortar shares on the main list of the Nasdaq Tallinn Stock Exchange will commence on December 14th or a date close to it.

The expected timetable of the offering is as follows:

28 November 2023 | Publication of the Prospectus |

28 November 2023 at 10:00 (Estonian time) | Offer Period commences |

7 December 2023 at 16:00 (Estonian time) | Offer Period ends |

On or about 11 December 2023 | Decision on the Offer Price and allocation of the Offer Shares |

On or about 13 December 2023 | Settlement of the Offering |

On or about 14 December 2023 | Listing and commencement of trading of Shares on the Nasdaq Tallinn Stock Exchange. |

AS Infortar's primary public offering organizers are LHV and Swedbank. Ellex Raidla serves as Infortar's legal advisor, while Cobalt is the legal advisor for the banks involved. Hamburg ja Partnerid is the communication advisor. Detailed information about the offering is available in the prospectus, accessible electronically on Infortar's website (https://infortar.ee/et/ipo) and the Financial Supervisory Authority's website www.fi.ee.

Infortar operates in five countries, with its main areas of activity in energy, maritime transport, and real estate. It holds nearly a 42 percent stake in AS Tallink Grupp, 100 percent ownership of AS Eesti Gaas, and a diverse and modern real estate portfolio of around 100,000 square meters. In addition to these core areas, Infortar is involved in construction, mining, printing, taxi services, and other sectors. The Infortar group comprises a total of 104 companies: 48 group companies, 5 associates, and 50 subsidiaries of associated companies. Excluding associated companies, Infortar employs 1,333 individuals.

Before making an investment decision, investors should read the Prospectus and the summary of the Prospectus and, if necessary, consult with a person specialising in advising on such investments.

Further enquiries:

Kadri Laanvee

Head of Investor Relations of AS Infortar

----Important notice——

This notice is not intended for distribution directly or indirectly in the United States or in any other country where dissemination, sharing, or transmission would be unlawful or to persons subject to financial sanctions by competent authorities. This notice is an advertisement and not a prospectus within the meaning of the Prospectus Regulation. Before making any investment decision regarding the securities referred to in this notice, investors should read the prospectus to fully understand the risks and benefits associated with the investment. The company's shares are publicly offered only in Estonia. The prospectus is available on the Financial Supervisory Authority's website (www.fi.ee) and the company's website (https://infortar.ee/et/ipo). The approval of the prospectus by the Finantsinspektsioon (Financial Supervisory Authority) should not be construed as an endorsement of the securities.

Jacking of viaducts in Tallinn

Tallinn's Tondi district witnessed a groundbreaking engineering endeavor with the installation of two massive 500-ton viaducts. The construction process employed a specialised technique, strategically building the viaducts alongside the railway and later shifting them into position using hydraulic jacks and rails equipped with Teflon pads.

"If such large viaducts were built in their final location, railway traffic would be closed for several months due to construction. In Tondi, the viaducts were built next to the railway embankment and only then pushed into their final location. We were able to position the viaducts in two days, and the overall interruption of railway traffic lasted nine days," noted Robert Sinikas, a member of the board of INF Infra OÜ, an engineering and construction company belonging to the Infortar group.

"The solution proposed by engineers allows saving time in the construction of tunnels and bridges. Shortening the interruption time of railway traffic is critically important," said Sinikas.

The viaducts, weighing five hundred tons each, were moved into place in two parts, a method not previously used in Estonia for viaducts of such length. The tunnelling work was carried out by INF Infra OÜ, a company belonging to the Infortar group. The same company is currently constructing the longest arched bridge in Estonia in Pärnu, where a 1200-ton arched bridge structure will be assembled on the shore and then lifted into its final position over the river using special lifting equipment.

The main contractor for the construction of the two-level crossing at Tallinn's Tondi railway crossing is Leonhard Weiss OÜ, and the client is the Tallinn Environment and Utilities Department. The two-level crossing will be completed by the end of next year, and in addition to the viaduct, the access roads will also be renewed. The total cost of the project is estimated to be 9 million euros.

Watch the video of the jacking of Tondi viaducts: https://www.youtube.com/watch?v=INc8Y15kLDE]

The opening ribbon, held by Puuluup members Ramo Teder and Marko Veisson, is being cut by architect Indrek Tiigi, Infortar management board members Eve Pant and Ain Hanschmidt, and chairman of the supervisory board Enn Pant. Photo: Ardo Kaljuvee

The opening ribbon, held by Puuluup members Ramo Teder and Marko Veisson, is being cut by architect Indrek Tiigi, Infortar management board members Eve Pant and Ain Hanschmidt, and chairman of the supervisory board Enn Pant. Photo: Ardo Kaljuvee